29.07.25 - Trade deal - new catalysts needed

The US and Europe reached a trade deal over the last weekend. Most European goods, including cars, exported to the US will face a 15% tariff while the Europe agreed to purchase USD 750 billion worth of US energy.

So what could be the next catalyst? This week in July is packed with market-moving events that could set the tone for August:

Earnings report from more Magnificent 7 companies like Meta, Microsoft, Amazon and Apple

The Fed rate decision (expected to remain unchanged)

The PCE Price Index (Personal Consumption Expenditures), the Fed’s preferred inflation reading

US jobs data for July

Markets: Equity indices higher across the globe with US reaching new records, except some Asian indices this morning - yields tending lower - USD claims back som ground - gold trading above USD 3’300/oz - cryptos taking a breather

My view: Summer season is often characterized by no big market moves. So far no signs of any summer lull. This time is packed full of events which could give markets any direction.

The market was cheering the trade deal only in the first hours. This was not much of surprise to me. European is clearly taking the second seat.

Therefore European economy continues to follow a path on the edge. There is much more room for a downside than upside surprise for the time being.

However, already a day after, markets seem to shrug off the negative news. Just a day after the trade deal headlines, sentiment is back to bullish. This year seems definitely to be different.

What could challenge the rally in the short-term:

Seasonality: August and September are historically the weakest months of the year

Valuation seems to be stretched in certain sectors and companies

Earnings disappointment continues in Europe: Only 55% beat estimates, below average

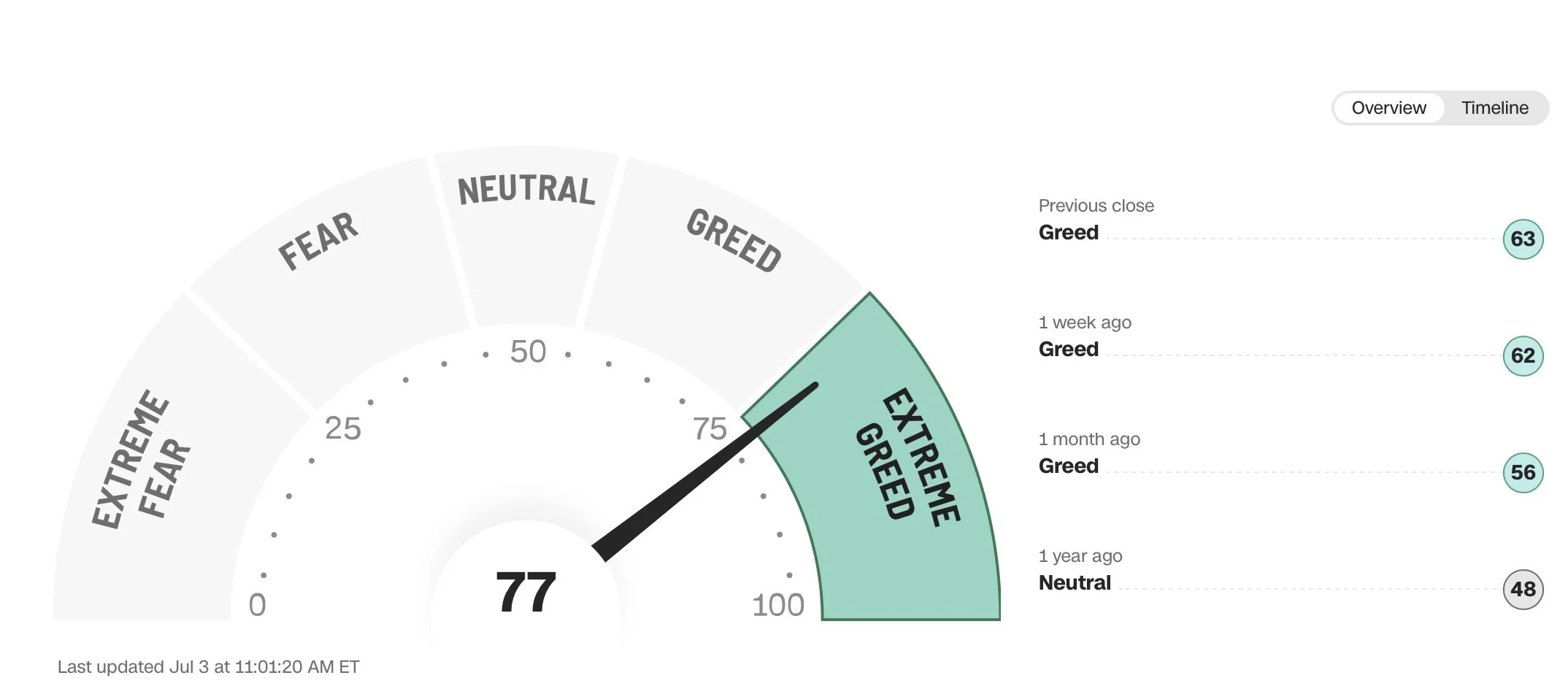

Investor sentiment: still hovering at extreme greed levels

Insider selling: Insider transactions are near record highs - insiders are cashing out

Fund Manager Survey: latest low cash levels indicate a contrarian signal

And finally, next to all those financial and macroeconomic and technical events and indicators, we are reaching the 1 August deadline when US President Donald Trump will announce the reciprocal tariffs for the countries without no agreed deal yet - except he is moving the deadline again. Current numbers mentioned are between 15 to 20% tariffs.

Stay tuned and see what the mixed cocktail will bring.

25.07.25 - Trump vs. Powell: Clash at the Fed

President Trump made a rare visit to the Federal Reserve, sparking headlines with a pointed exchange over cost overruns at the Fed’s new HQ.

Trump later told the press he doesn't consider it “necessary” to fire Powell, though the visit itself sends a clear message: the White House is watching the Fed closely.

Markets: US Futures did not react on the news - US long-term yields higher together with the US dollar - gold price slightly lower

My view: The Fed and Powell will stay the course to fulfill the mandate and Fed targets and therefore remain data-driven.

But Trump’s move adds political noise just a week before the next rate decision. And the visit signals growing pressure on the Fed to cut rates. However, the Fed is very likely to keep the rates unchanged at the next FOMC meeting. Should the economy weaken, Trump could point to Powell as a source of policy failure.

Chair Powell’s term officially runs until 15 May 2026, and he’s likely to stay the course unless forced otherwise.

Not as before, investors seem now to take latest clash relaxed for the time being. Higher US yields and US dollar indicate that markets do not believe on a case that Powell gets fired in the short-term.

24.07.25 - ECB on pause

Today, the European Central Bank (ECB) kept its key interest rate unchanged at 2.00%, pausing its rate cut cycle after the initial move in June. The decision was widely expected as the ECB assesses incoming data before committing to further easing.

During the press conference, ECB president Christine Lagarde emphasized the ECB’s data‑dependent, meeting‑by‑meeting approach, warning that policy will remain flexible and unconditional on forward guidance, a lot also depending on trade outcomes. She also highlighted certain downside risks to growth and acknowledged that inflation uncertainties remain.

Markets: European equities ended lower after the ECB meeting - the euro initially strengthened, but reversed gains during evening trading - gold moved higher - European bond yields ticked up slightly

My view: The ECB is not ready to commit to the next cut. Growth risks are rising, but inflation is still sticky in parts of the economy and can accelerate depending on trade deal outcome and rising commodity prices.

Lagarde’s cautious tone shows the ECB is walking a tightrope: too dovish and they risk losing credibility, too hawkish and they may tip Europe into deeper stagnation.

The ECB’s decision to maintain rates at 2 % reflects a cautious tactical pause, recognizing that although inflation is on target, external trade shocks, a strong euro, and geopolitical uncertainty justify a measured and flexible stance. The outlook depends heavily on trade developments and evolving inflation trends, with future rate moves to be determined meeting‑by‑meeting.

That’s not supportive for business confidence or long-term planning. With risks of eurozone weakness persisting and limited policy support ahead, the case for a softer euro remains intact despite short-term fluctuations.

Disclosure: Euro fully hedged against the Swiss franc

23.07.25 - Watch tech giants’ earnings

Tonight, after market close, the first two tech giants will report Q2 earnings: Alphabet and Tesla. They’re among a broader group of companies publishing results.

Markets: Both Alphabet and Tesla are trading slightly lower in pre-market, while tech futures show a modest gain at the time of writing.

My view: Expectations are high. Investors have priced in strong results, so even a small miss could trigger sharp downside. Given their weight in the Nasdaq, results may drive significant index moves and volatility.

On the other hand, if both deliver upside surprises, we could see US indices jump and set new record highs.

Tesla’s weakness in its core business, EV sales, is likely to persist. Despite this, speculative investors are increasingly focused on the company’s new robotaxi initiative, viewing it as a major future growth driver. However, competition in the autonomous mobility space is already intense, and success is far from guaranteed.

As for Alphabet, I expect that many companies may scale back marketing and advertising budgets in the current environment. In times of uncertainty, especially with the unresolved tariff conflict, cost control becomes a priority, which could weigh on Alphabet’s short-term revenue.

Remember: Speculation remains elevated. This environment can persist. But it can also reverse abruptly on any unexpected event.

Disclosure: Short position in Tesla

23.07.25 - New trade deal - Japan

Japan has joined the small group of countries reaching a trade agreement with the US. Overnight, both sides announced a deal that reduces reciprocal tariffs to 15%, down from the previously proposed 25%. The agreement notably includes the auto sector. Japanese car exports to the US, which accounted for 28.3% of total Japanese shipments in 2024, will now face a 15% tariff, rather than the universal 25% rate imposed on other nations.

So far, the UK, Japan, Vietnam, and Indonesia have finalized trade deals with the US. China has agreed to a 90-day framework, currently under ratification.

Markets: Nikkei 225 Index jumps almost 4% - Japanese yen weakened while Japanese interest rates ticked slightly higher

My view: Markets are cheering the deal. While 15% appears more favorable than 25%, the cost is simply shifted, either to corporations or consumers. That will weigh on consumption, sales, and ultimately earnings. So far, the market is ignoring these second-order effects.

The latest deal announcement may trigger some spillover optimism in Europe. While nervousness rose in recent days ahead of the August 1 tariff deadline, renewed hopes are building that the EU might still reach a deal in time.

Switzerland, which hasn’t yet received a tariff letter, remains in active talks to strike a deal.

I’m holding off on adding equity exposure at current market levels, only considering selective opportunities if they emerge. Several red flags highlighted in recent days continue to support a cautious stance.

Note: The ETFMandate portfolio currently holds no allocation to Japan.

21.07.25 - Next alert - from Fund Managers

Bank of America’s latest Global Fund Manager Survey is flashing a “sell” signal as average cash holdings among institutional investors dropped to 3.9% in July, down from 4.2% in June. Historically, cash levels below 4% have triggered a contrarian warning. Since 2011, similar readings led to a median 4-week S&P 500 decline of -2%. The worst post-signal drawdown reached -29%, while the best return was a modest +3%.

The report also highlights a historic record surge in risk appetite over the last three months. Investor sentiment is now the most bullish since February 2025, driven by the strongest jump in profit optimism since July 2020.

Markets: European markets are lagging and even negatively performing while US indices hover near record highs, supported by momentum in tech, falling volatility, and steady inflows - gold price is up with other metals trading close to USD 3’400/oz - interest rates and US dollar both decline - most cryptos take a breather after latest rally

My view: Speculation is heating up, and today brought more signs confirming it. Most steel producers rallied several percentage points, driven by renewed optimism.

The catalyst? China announced the official start of the construction on a massive hydropower project in Tibet, set to become the world’s largest. With an estimated cost of USD 167 billion, the mega dam is expected to fuel substantial demand for raw materials, particularly steel and cement.

Speculative investors were quick to react, jumping into related stocks in hopes of riding the momentum. However, such price spikes rarely prove to be sustainable beyond the initial headline reaction.

Despite the rally in cyclical sectors, macro risks remain largely ignored, including tariffs, elevated valuations, and geopolitical uncertainties.

At the same time, market sentiment has reached extreme levels. Such crowded positioning and elevated optimism, markets are increasingly vulnerable to unexpected shocks. While no single indicator should dictate timing, this “sell” signal from the Fund Manager Survey adds to a growing list of caution flags. This environment favors tightened risk management, potential profit-taking, or hedging strategies, especially for those with significant exposure to momentum-driven assets.

in the ETFMandate portfolio, I’ve continued to reduce exposure gradually over recent weeks by placing stop orders to protect gains.

18.07.25 - Retail revival: US consumers join the party

US retail sales rebounded in June, according to Thursday’s report from the US Commerce Department. Headline sales rose 0.6% month-over-month outperforming nearly all forecasts in a Bloomberg economist survey (consensus estimate 0.1%. This marks the first increase in three months.

Meanwhile, import prices rose just 0.1%, softer than the 0.3% consensus. This points to foreign exporters seem to absorb tariff costs by cutting their prices.

Markets: Markets continue to rise - US long-term yields trading around 4.45% - US dollar down - gold back above USD 3’350/oz - altcoins continue their rally

My view: The retail rebound is encouraging, but likely reflects confidence driven by market strength and could be another case of front-loaded consumer activity ahead of uncertainty.

The newly announced tariffs are set to take effect on August 1, unless trade deals are struck or the deadline is delayed, again. For now, soft import price data offers temporary relief, but it doesn’t remove the risk.

Someone will pay the tariffs. At this stage, it appears foreign producers are discounting exports to preserve market share. However, that’s unlikely to be sustainable. As earnings pressure builds, exporters will be forced to pass on costs, especially if tariffs widen or remain in place for longer.

17.07.25 - No fear! Shaking off negative news and Powell firing rumors

Wednesday brought renewed political drama as markets reacted to rumors that Donald Trump was preparing to fire Federal Reserve Chair Jerome Powell. The New York Times reported that Trump had shown House Republicans a draft termination letter. A senior White House official later told CNBC that Trump asked lawmakers whether he should proceed, and received support.

This pressure campaign against Powell is not new. Trump has already several times criticized the Fed chair for not cutting rates in the face of economic headwinds and inflation concerns. Powell, meanwhile, has maintained a more cautious stance, indicating the central bank would keep rates steady until it sees more clarity on inflation and the economic impact of tariffs.

Later in the day, Trump walked back the firing talk, calling such a move "highly unlikely," calming nerves after a few volatile hours.

Markets: Major equity markets are trading flat or higher - US long-term yields unchanged - US dollar stronger - gold slightly negative while most cryptos bounce except Bitcoin.

My view: Markets are showing a remarkable ability to shrug off risks, even ones that would historically have sent shockwaves through financial systems. The idea of a US president firing a Fed chair mid-term would normally trigger widespread concern over the central bank’s credibility and independence.

That this episode caused only a short-lived dip highlights today’s speculative environment, where negative headlines are quickly dismissed or reversed by a new tweet or statement. But this doesn’t mean the risk is gone, it’s simply being ignored.

Markets remain vulnerable to political volatility, especially when it involves monetary policy. I see this as another sign of complacency and a growing gap between headline risk and market reaction. It’s a dangerous divergence that could lead to sharper corrections once sentiment turns.

On the interest rate policy front, Powell has no urgency to cut rates. Based on recent economic data, the Fed is likely to hold steady. But should the US economy weaken, whether from tariffs or other shocks, Trump could have someone to blame.

15.07.25 - Market Drivers: China growth - US inflation

China’s economy grew by 5.2% in Q2 2025, slightly above the 5.1% consensus forecast, but down from 5.4% in Q1. This signals continued but slowing growth momentum. However, retail sales grew only by 4.8% YoY (estimated 5.6%), down from 6.4% a month ago while industrial production topped forecasts growing 6.8% (estimated 5.6%), up from 5.8% a month earlier.

In the US, the June CPI report showed a modest rise in inflation. Headline CPI increased to 2.7% YoY (vs. 2.4% in May), just above expectations. Core CPI remained unchanged at 2.9%, matching forecasts.

Markets: Asian equities mixed this morning, European equities lagging, US futures positive while yields are unchanged and US dollar gains - cryptos and gold see some price drop.

My view: China’s beat is statistically welcome, but the deceleration in consumer growth highlights some existing fragilities. In case needed, the government will selectively add some stimulus to support a growth rate around the 5% target.

The rise in June inflation is not alarmingly, however could reinforce hopes that rate cuts remain on the horizon. In my view, Fed narrative remains “higher for longer” why markets may need to adjust overly dovish rate cut bets.

From a valuation and risk-return perspective, China currently looks more attractive than the US. While sentiment on China remains weak, it offers better upside potential with limited downside, particularly for patient, contrarian investors. Meanwhile, US equities appear priced for perfection, and are vulnerable to disappointment, especially if inflation stays sticky and rate cuts get delayed further.

14.07.25 - Relaxed investors despite latest tariff letters

The White House has issued fresh tariff letters during weekend, announcing 30% duties on exports from the EU and Mexico, effective August 1, 2025, adding to earlier measures on other countries.

In response, the EU has postponed retaliatory tariffs on EUR 21 billion of US goods to maintain negotiation leverage, while preparing a wider package as a countermeasure.

Markets: European equities slightly down - US indices trading sideways with long-term yields almost unchanged as well as the US dollar - gold giving up earlier gains - Bitcoin reaches new all-time high with USD 123’200

My view: Markets are brushing off tariff risks, for now. Despite the seriousness of the tariff moves, investors are maintaining a surprisingly relaxed stance, assuming Trump will soften again (TACO: Trump Always Chickens Out). But the tariff train has left the station, and the damage may not be visible immediately. Companies are on hold with new investments since some month with all uncertainties around the tariff topic.

All these measures come during a period of already stretched valuations and reaching a euphoric sentiment. I see asymmetrical risks ahead: limited upside from here, while the downside, if tariffs are enforced or retaliated, could be sharp. I remain cautious, keeping hedges in place and stops tight. Market calm may be deceptive.

10.07.25 - Record - record - record -record

Another day, another all-time high:

NVIDIA becomes the first company ever to reach a USD 4 trillion valuation

US indices hit fresh highs, led by Tech stocks

Bitcoin climbs to a new record

FTSE 100 index (UK) touches an all-time high this morning, powered by mining stocks

Markets: Global stock indices up (Asia, Europe) - US Futures sideways after the rally - US dollar, long-term yields, cryptos flat - gold back above USD 3’300/oz level.

My view: Markets keep breaking records. But this rally is increasingly fueled by speculative momentum, not fundamentals. The current pattern is not a healthy move and resembles classic euphoria territory: bad news is ignored, risks are discounted, and nearly every stock moves in just one direction, up.

A more cautious stance starts to be warranted. We're likely in the overshooting phase, which can persist longer than expected. But when reality bites, corrections tend to come fast, and could be even hard.

Personally, I’m not chasing the final stretch. The risk-reward ratio is no longer attractive. With an anti-cyclical stance, I believe it’s time to: Tighten stops, reduce exposure and take some chips off the table.

09.07.25 - More tariffs - targeting commodities

US President Donald Trump is targeting a new market in his global trade war: copper. He announced plans to impose a 50% tariff on copper imports, triggering a sharp reaction in commodity markets. Copper futures in New York soared, posting their largest intraday gain in decades following the announcement.

While Trump did not provide a precise implementation date, he suggested the tariffs could be enacted within the next 12 to 18 months.

Markets:Copper futures jumped more than 10% yesterday in New York - no impact on other precious or industrial metals - most posting small declines today.

My view: The commodity sector is back in the spotlight. While gold has been a focus for several years, attention has increasingly shifted to other metals and rare earths since April this year.

The global fight for resources is intensifying. China, the world’s largest producer of rare earths, is tightening export controls. Only a comprehensive trade deal with the US could ease some tensions. Rare earth elements are critical across the technology spectrum, from electric vehicles to military applications.

The market’s reaction to the copper tariff news has been strong. Yet, considering limited global supply and rising structural demand, copper prices together with other metals with a supply deficit like platinum may still have room to climb. That’s why I continue to hold my copper exposure together with other metals like platinum, silver and gold.

I’ve built most of this commodity exposure over the past few months, particularly following Trump’s announcement, planning a rare earth deal with Ukraine, which I interpreted as a clear signal: the global race for limited resources is accelerating.

Position Disclosure:

- Copper ETF (3x leveraged) Performance sind last buy: 102.9% - 09.04.25

- Silver ETF (3x) 66% - 09.04.25

- Platinum ETF 45.8% - 09.04.25

- Gold ETF 0.3% - 20.05.25

- Gold Miners ETF 13.9% - 20.05.25

- Global Miners ETF 21.0% (net) - 26.02.24

- Rare Earth Miners ETF 7.2% (net) - 28.02.25

- several mining stocks (not specifically mentioned here)

08.07.25 - 23 more days to ignore tariffs

President Donald Trump yesterday announced a new round of unilateral tariffs affecting 14 countries, set to take effect on August 1. Among the major trading partners, Japan and South Korea received the most favorable treatment, each facing a 25% tariff. Other countries were assigned rates ranging up to 40%.

All tariffs have now been synchronized to the August 1 implementation date, giving countries a limited window to negotiate more favorable terms before the deadline.

In response, the European Union is reportedly seeking a preliminary agreement with the US in an effort to secure a 10% tariff rate that would remain valid even beyond the August deadline.

Meanwhile, like many EU countries, Switzerland is still awaiting its official tariff letter from Washington.

Markets: Asian equity indices up during the last trading session - European and US equities trading sideways while long-term yields are rising - US dollar weaker - gold price remains above USD 3’300/oz.

My view: Despite the latest tariff announcement from President Donald Trump, investor sentiment remains largely unconcerned. With the new implementation date now pushed to August 1, markets have effectively been granted another 23 days to ignore the issue. Trump had previously marked July 9 as a hard deadline - now postponed. Is this yet another case of "TACO" (Trump Always Chickens Out), or just a “semi-TACO” delay?

One thing is clear: a day will come when tariffs are defined and enforced. The US needs additional revenue to fund the “Big Beautiful Bill,” which includes substantial tax cuts. Betting on a world without tariffs is therefore redundant. The real question isa: who will ultimately pay the price? Consumers or corporations? That answer will only emerge in the months ahead.

While the August 1 deadline buys time, it does not buy certainty. Markets remain priced for perfection, with investor positioning still reflecting high levels of optimism. That complacency leaves room for a sharper correction if reality falls short of expectations.

07.07.25 - Who receives a letter

Donald Trump has confirmed that letters outlining new unilateral tariffs will be delivered to 12 key trading partners starting today, Monday at noon Washington time. These letters are said to include “take it or leave it” offers, essentially marking the final stage of negotiations.

The deadline to reach a deal remains set for July 9, with tariffs scheduled to take effect on August 1.

Trump has warned that countries failing to strike an agreement could face tariffs reverting to the levels proposed back in April. Meanwhile, Treasury Secretary Scott Bessent suggested that some countries may be granted limited flexibility to finalize agreements, but no official extensions have been confirmed. Major partners like the EU, Japan, and South Korea are still negotiating under growing pressure.

Markets: Most equity indices are trading sideways, US Futures slightly negative, US yields up together with the US dollar, commodities (metals) fall slightly while cryptos remain stable.

My view: The August 1 start date gives markets more time, but not more certainty. What matters most is the tariff rate each country finds when they open their letter. I believe markets are still underestimating Trump’s determination. Should tariffs be implemented as outlined, Trump mentioned a 70% tariff rate last week again, the market reaction could be swift and negative. However, in the days ahead, any last-minute deals may spark short-term relief rallies.

One more factor to keep in mind: investor sentiment has reached “Extreme Greed”, a classic contrarian signal that often precedes market turning points.

03.07.25 - “Extreme Greed” level

In a shortened trading session ahead of Independence Day, US equity markets surged to fresh record highs — marking the fastest recovery in history since the April lows, even surpassing the pace of the 1998 rebound. That year, incidentally, also marked the start of my first market experiences.

What Drove Markets Today:

1. Strong Labor Market Data:

Latest figures once again confirmed the resilience of the US job market:

Unemployment rate: 4.1% (vs. 4.2% expected)

Nonfarm payrolls: 147k (vs. 110k expected)

Initial jobless claims: 233k (vs. 240k expected)

2. Political Momentum:

The much-discussed tax and spending proposal, dubbed the “Big Beautiful Bill”, featuring tax cuts, immigration funding, and the rollback of Biden-era green energy incentives, appears to be clearing its final legislative hurdles as the news just dropped in this moment that the house passed it.

3. Sentiment & Speculation:

Momentum and optimism dominate the current phase. The ongoing “TACO trade” (Trump Always Chickens Out) in combination with retail-driven flows overpowering cautious institutional positioning has pushed the CNN Fear & Greed Index back into “Extreme Greed” territory, a level briefly reached last October.

Markets: US indices closed at all-time highs, while the US dollar and bond yields saw a modest bounce heading into the holiday.

My view: As I’ve outlined in previous blog posts and Market Insights, extreme sentiment levels can serve as powerful contrarian signals. When the market enters “Extreme Greed,” the probability of a pullback or consolidation increases. While speculative phases can stretch further than expected, these moments often mark a good time to consider taking some profits.

With the trade deal deadline just a few days away, investors may soon face a reality check: the underlying macro picture is not as flawless as current index levels suggest.

How I’m Aligning the Portfolio to Current Market Conditions

For positions that have performed well recently, I’ve set stop levels to protect gains in case the market turns, adjusting levels up on a regular basis.

At the same time, I’ve taken measures in recent weeks to benefit from a potential correction, increasing short positions and adding long exposure to volatility.

Stay tuned to ETFMandate. I’ll continue to keep you informed with sharp, timely updates on what truly matters for your investment decisions and your portfolio.

03.07.25 - Deal 3 of 90

Last night, US President Donald Trump announced a preliminary trade agreement with Vietnam. Based on early released details, the deal includes:

A 20 % tariff on Vietnamese exports to the US, down from an initially proposed 46% during “Liberation Day”.

A 40 % tariff on trans-shipped goods, aimed at blocking rerouted Chinese exports.

Zero tariffs for US exports into Vietnam.

There is no final implementation date yet. It is a framework deal with further negotiations pending.

Markets: after latest rally, Vietnamese stocks declined after the announcement and the currency weakened - short-term positive reaction on some apparel stocks exposed to Vietnam (Nike, On Holding, Lululemon)

My view: On first sight, the newly announced tariff deal with Vietnam appears less severe than initially feared. The originally proposed 46% tariff was scaled back to 20%, offering some relief. However, this remains a net negative for Vietnamese exporters: costs are still rising, and competitive pressure within the region will intensify as global buyers may reassess supply chains.

For context, markets prices in an average US tariff level of roughly 15%. We have now UK with 10%, China 55% and Vietnam 20%.

The Vietnam agreement marks deal number three out of 90, as part of Trump’s “America First” strategy to restructure global trade away from China and bringing production back to the US. There are only six days remaining until the July 9 deadline. Hopes for a wave of last-minute deals are not fading yet. Clearly, the number of concluded agreements is far below what markets had anticipated just weeks ago.

Will Trump extend the deadline? He stated firmly: no. Will he hold the line this time?

Markets are still betting on the so-called TACO trade — Trump Always Chickens Out. By now, the speculators got the reward for taking the risk. Will it soon going to be different?

For me, this is clearly not the end of tariff risk. The latest deal may support short-term market optimism, with hopes rising for more agreements to follow during the next days. However, under the surface, the risks and negative side effects from already-announced or soon-to-be-implemented tariffs implemented tariffs remain. The structural damage may still unfold over time, especially in terms of inflation, supply chain realignments, and corporate margins.

Position Disclosure:

I am invested in Vietnam via an ETF with a long-term investment horizon.

01.07.25 - Trump vs. Musk - Round 2

After the first clash in early June, Elon Musk attempted to de-escalate tensions on June 11, posting on X that he “regrets some of his posts… they went too far.”

For context, revisit the original analysis: Trump vs. Musk, published 6 June 2025 in ETFMandate Market Insights.

But today, the feud reignites.

President Donald Trump publicly accused Elon Musk of profiting excessively from EV subsidies and hinted that the Department of Government Efficiency should investigate. This came shortly after Musk threatened to increase political donations against Republicans backing Trump’s new tax bill.

Markets: Tesla stock is sharply lower, trading around USD 300, down more than 5%.

My view: While this story is unlikely to drag broader markets lower on its own, it does have an impact on the index due to Tesla’s significant weight as part of the Magnificent 7.

The disagreement highlights deeper tensions around US fiscal policy. The proposed tax bill and the persistently high US debt levels are critical themes that could shape markets in the near to mid-term. I’ll continue to monitor developments closely. As always, ETFMandate will keep you informed in real time.

Negative news around Tesla continues to pile up. Latest delivery figures confirm a persistent sales slowdown. The much-hyped robotaxi vision is facing delays and technical issues with no clear sign of near-term monetization. This is far from what bullish investors had hoped for.

Position Disclosure:

As mentioned before, I initiated a short position on Tesla 20 May 2025 at USD 353.63. A transaction instantly communicated to ETFMandate Premium Members via the Premium Newsletter.

30.06.25 - Investors bet on trade deals

US markets are continuing their upward momentum as traders grow increasingly optimistic about the likelihood of trade agreements being finalized in the coming days. Despite the lack of substantial confirmed details, recent moves suggest positive sentiment. Canada, in an attempt to restart trade talks, has scrapped tariffs on major tech companies, signaling a potential thaw in relations after President Trump halted trade negotiations with the country last Friday.

Markets: US markets continue to outperform major indices while US yields are falling - Gold is up while cryptos are losing some ground - US dollar is weak while Swiss franc continues its uptrend

My view: The rally in US equities continues to be fueled by growing hopes of a swift resolution to ongoing trade negotiations. However, with the deadline fast approaching and limited concrete information available, I remain cautious. Market movements are currently driven more by speculation and sentiment than by confirmed policy outcomes.

At these elevated levels of pure optimism, markets become increasingly vulnerable and could react sharply to any negative news.

Even the SNB lowered interest rates to 0% in June, there is ongoing demand on the currency. The strength of the Swiss franc suggests some risk-off sentiment in global markets, potentially signaling a flight away from the US dollar. Investors may be beginning to question the sustainability of US household spending and the ongoing debate over the "Big Bill" in Congress, which could have significant fiscal implications.

In the short term, while there may still be room for upside driven by optimism, the risks surrounding trade deal uncertainties and geopolitical tensions should remain front of mind.

Additionally, I believe tariffs will persist, and investors may be underestimating the inflationary pressures that could arise, leading to upward pressure on interest rates in the near future.

27.06.25 - Chasing highs, ignoring risks? Wall Street in summer mode

Markets have once again climbed to fresh record highs, with major US indices extending their gains as June draws to a close. The S&P 500, Nasdaq, and Dow all touched new highs this week, shrugging off persistent geopolitical noise and pockets of overvaluation.

What's fueling this seemingly chilled-out rally? A combination of softer inflation impulses and revived optimism around a potential Fed rate cut as early as September or even July. Adding fuel to the dovish narrative are growing rumors of a potential replacement for Fed Chair Jerome Powell later this year, possibly with a more accommodative successor.

Markets: US Futures continue to climb, European equity indices follow the US rally while China is lagging - US interest rates drop - profit taking in commodities and metals.

My view: This market feels almost too relaxed. With volatility compressing and equities grinding higher, Wall Street seems to have entered a phase of “detached optimism.” The cooling in oil prices and dovish Fed signals are enough to keep the party going for now, but complacency is creeping in.

From a strategic point of view, this sets up a tricky dynamic:

On one hand, the path of least resistance remains up, especially if institutional investors feel pressure to chase returns into quarter-end.

On the other hand, valuation risks are accumulating, particularly in tech-heavy indices that are already priced for perfection.

I remain cautiously tactical here, not chasing highs. The next meaningful market move may hinge on whether the Fed’s dovish tone translates into actual policy action, and on how Q2 corporate earnings shape expectations for the second half.

Let’s also not forget the unresolved tariff and trade negotiations, with a fast-approaching deadline on July 8. For now, summer calm prevails, but beneath the surface, key catalysts for renewed volatility are quietly gathering momentum.

26.06.25 - Big institutional money flow?

Yesterday’s equity market action presented a rare and telling pattern. During European trading hours, indices reflected the signature of significant institutional flows. Was a major bank offloading equities throughout the day?

Markets: European indices steadily declined throughout the day, with US equities following suit. US indices managed to break free from this downtrend in the final hour of trading.

My view: Despite a high number of economic and geopolitical uncertainties, markets are approaching record highs. This recent rally has been predominantly driven by retail investors, with institutional investors largely sitting on the sidelines. The critical question in the coming days or weeks is which camp will prove correct. Retail investors, fueled by the so-called TACO trade (Trump Always Chickens Out) and speculation, bought heavily during the post-correction bounce after “Liberation Day.”

How will institutional investors respond? Will they be forced to chase these rising indices at record levels, potentially fueling a further rally? Or, given current valuations, will they use these elevated levels as an opportunity to continue reducing risk in their portfolios? Based on my experience working with large financial institutions, yesterday’s market action pointed to a significant seller in equities, unloading throughout the day.

As the deadline for the suspended tariffs approaches, we should expect market sensitivity to this issue to resurface. These tariffs were put on hold for 90 days and have largely been out of the spotlight for the past 80 days.

Reflecting on my own positioning, I admittedly did not follow the retail crowd and missed out on the recent upside, anticipating further downside as discussed in my previous views. The market, however, appears unprepared for the looming tariff concerns. This underpricing of risk is why I expect higher volatility in the near future, with the potential for a downside correction. Q2 earnings will likely serve as the next key catalyst, driving the market in one direction or another based on the results.